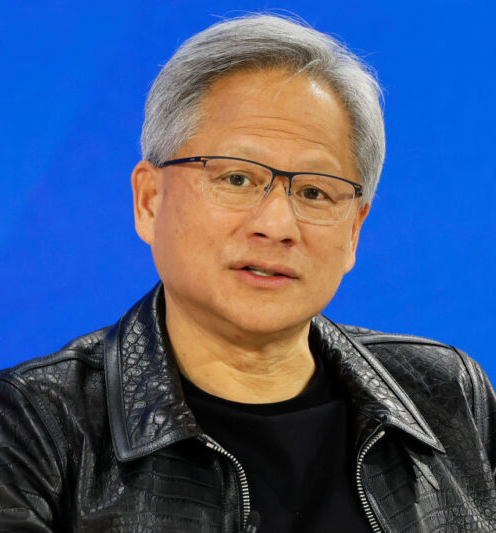

At the just-concluded New York Times DealBook conference, Nvidia CEO Jensen Huang made eye-catching remarks. He predicted that it may take the United States as long as two decades to establish an independent domestic chip supply chain. This time period may seem far away, but it actually implies a major challenge and opportunity in the technology world.

As a giant in the semiconductor industry, NVIDIA's success is inseparable from a global supply chain. “Our parts come from all over the world,” Huang said. This includes Taiwan Semiconductor Manufacturing Company (TSMC), which owns and manufactures the most advanced semiconductor technology in the world!

But Huang Renxun also admitted that it will take at least ten to twenty years to achieve complete independence in the supply chain. "Full independence is not realistic during this period." His words reminded us of the estimate earlier this month by Laurie E. Locascio, director of the National Institute of Standards and Technology, that the United States would Produce the world's most complex chips within ten years.

However, U.S. ambitions in the chip field are not without obstacles. Last month, the United States tightened export controls on sales of advanced technology to China by companies including Nvidia over national security concerns. Huang Renxun responded that they are looking for new ways to operate in China, after all, China is one of the largest semiconductor markets in the world. While he acknowledged that the new U.S. regulations are "absolutely necessary" for national security, Nvidia is also "developing products for China that will not trigger restrictions."

Huang Renxun said that we must develop new chips that comply with regulations, and once they comply with regulations, we will return to the Chinese market.

At the same time, Huang Renxun also emphasized the necessity of global market cooperation, and did not forget to mention the importance of national security and competitiveness.

Finally, it’s worth mentioning that although Nvidia was reported in The New Yorker this year to have achieved one of the largest single-day gains in stock market history, with its market value soaring by $200 billion, the company is reminding investors due to domestic export controls. A decline is likely this quarter.

Post time: Dec-01-2023